Update: On Tuesday, June 30, the Senate extended the Paycheck Protection Program through August 8. Senate leaders moved to keep the application process of the program open another 6 weeks, as there are still $130 billion in allocated funds left unused. As of this date, nearly 5 million small business owners across the U.S. have utilized the program.

Update: On Thursday, April 23, the U.S. House of Representatives passed a new coronavirus relief bill that will push over $320 billion toward the second round of funding for the Paycheck Protection Program, which ran out of funds just last week. The U.S. Department of Treasury has also released additional guidance on the program, which can be found here.

Update: On Thursday, April 16, the Paycheck Protection Program maxed out at $349 billion. The SBA website reads that it is “unable to accept new applications for the Paycheck Protection Program based on available appropriations funding. Similarly, we are unable to enroll new PPP lenders at this time.” Negotiations continue as lawmakers try to move past a stalemate about how additional federal funding should be allocated to existing relief programs, including the PPP.

On March 27, President Donald Trump signed the CARES Act into law to put money directly into consumers’ pockets and create loan programs for US businesses. These loan programs include a pool of funds that are being administered by the Small Business Administration (SBA), with the intent to help small businesses retain employees when possible. Let’s take a look at some of the ways the CARES Act does this.

Paycheck Protection Program (PPP)

The Paycheck Protection Program is a loan in the amount of a business’ monthly payroll x 2.5 with a maximum loan amount of $10 million per business and a maximum interest rate of 4% per annum designed to help small businesses keep their workers on their payroll while we move through the COVID-19 crisis. The SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is applied toward the costs of:

- payroll support, including employee salaries, paid sick or medical leave, insurance premiums

- rent and utilities

- certain group healthcare benefits

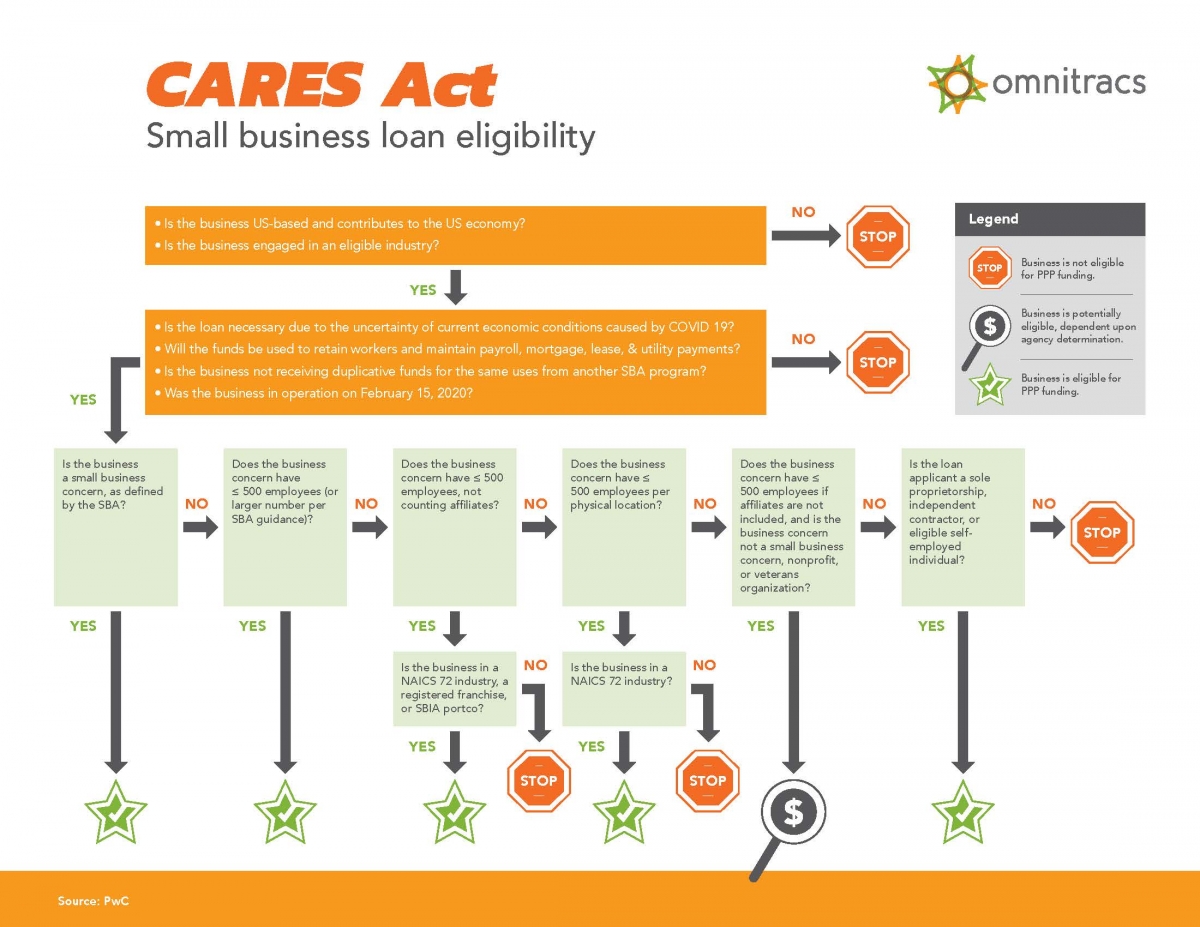

In order to be approved, a business must have 500 or fewer employees unless their industry’s standard is set above this threshold by the SBA. Applications will need to be submitted to SBA-approved 7(a) lenders, or any nonbank lenders approved by the U.S. Department of Treasury, by June 30, 2020. Visit this site for more detailed information.

Economic Injury Disaster Loans (EIDL)

The SBA is also offering small businesses suffering substantial economic injury as a result of COVID-19 low-interest federal disaster loans for working capital. These EIDLs offer up to $2 million in assistance with an interest rate of 3.75%. With a maximum repayment schedule of 30 years, these loans feature repayments over long terms in order to keep payments affordable. Terms are determined on a case-by-case basis, based upon each borrower’s credit score, or an appropriate alternative method for determining the applicant’s ability to repay. More EIDL highlights:

In addition to the entities that are already eligible for SBA disaster loans, eligibility is temporarily expanded between January 31, 2020 and December 31, 2020 to include these types of businesses as long as they were in business as of January 31, 2020:

- business entities with 500 or fewer employees

- sole proprietorships, with or without employees

- independent contractors

- cooperatives and employee-owned businesses

- tribal small businesses

- private non-profits of any size

Entities can apply for an EIDL online with the SBA. For questions, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800- 877-8339) or e-mail disastercustomerservice@sba.gov.

EIDL Emergency Grants

On top of the loans listed above, $10 billion has been appropriated for EIDL Emergency Grants of $10,000 or less through December 31, 2020. Applicants are approved by credit score or alternative means to determine their ability to pay as long as they were in business by January 31, 2020. The grants from this rapid fund program can be applied to the following:

- provide sick leave to employees

- maintaining payroll to retain employees

- meeting increased costs to obtain materials unavailable from the applicants

- making rent or mortgage payments

- repaying obligations that cannot be met due to revenue losses

These are grants that do not have to be repaid, but any amounts provided under these Emergency EIDL grants reduce the loan forgiveness you would receive under the Paycheck Protection loan if you are using that loan.

This content is for information purposes only. Seek financial advice from a trusted professional advisor.

For detailed information about these loans/grants visit:

https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses