At Solera, we are committed to providing the transportation industry with up-to-date tools and insights to inform everyday decision-making and strategy. That way, the fleets that fuel our supply chain can continue to execute on route and fleet management needs with efficiency and effectiveness while having the foresight to plan for future trends.

With that in mind, we are pleased to spotlight the second edition of our Fleet Industry Intelligence Report. We’ve analyzed data related to long-haul, last-mile delivery, seaport and safety transportation activity, set to a backdrop of recent and ongoing world events. It is our hope that, with the insights drawn from this analysis, transportation organizations can optimize their business goals and sustain success, even through periods of challenge and difficulty.

We’ve pulled from the largest collective fleet management database to source the report, combing through everything from miles driven and events reviewed to stops made. All the while, we use this data to continuously improve transportation intelligence and drive innovation within the industry while monitoring fleet asset risk and operational needs.

COVID-19’s Continued Effect

We now approach the two-year mark on a COVID-19 pandemic that has reimagined our collective way of life and how we address even the most basic, everyday tasks. Over the course of these past two years, every industry has been tested when it comes to their ability to be flexible, having to adapt or regress. The fleet industry was not immune to such changes, as evidenced by our data analysis. Findings regarding the pandemic’s effect on supply chain transportation include:

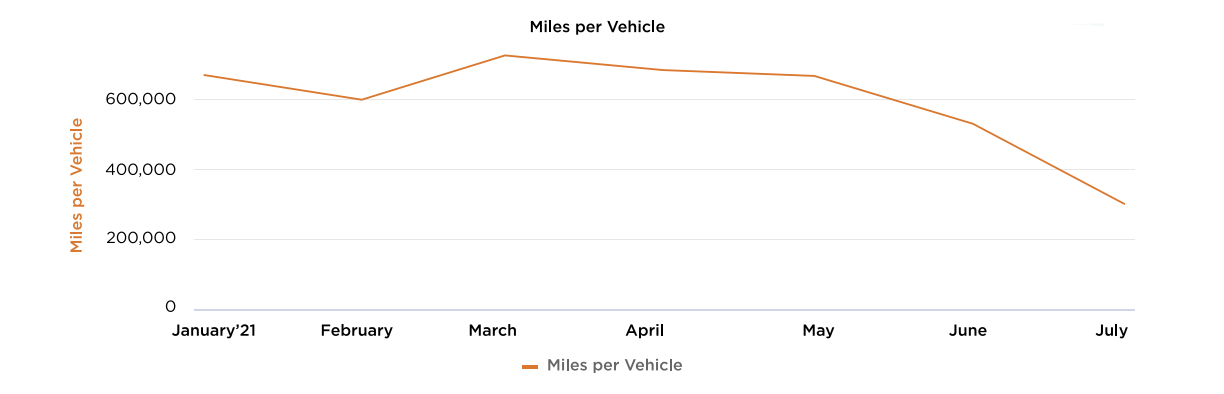

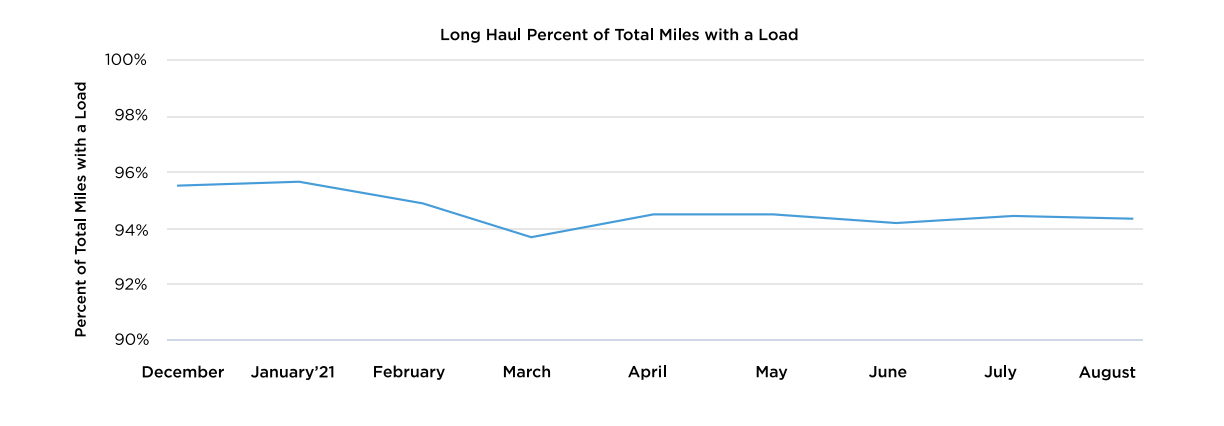

- Fleet management data shows long-haul vehicles are adapting and remaining productive. The report shows a slight decline in total miles traveled.

However, fleets remain productive - with trucks heavily loaded - showcasing an elevated level of efficiency

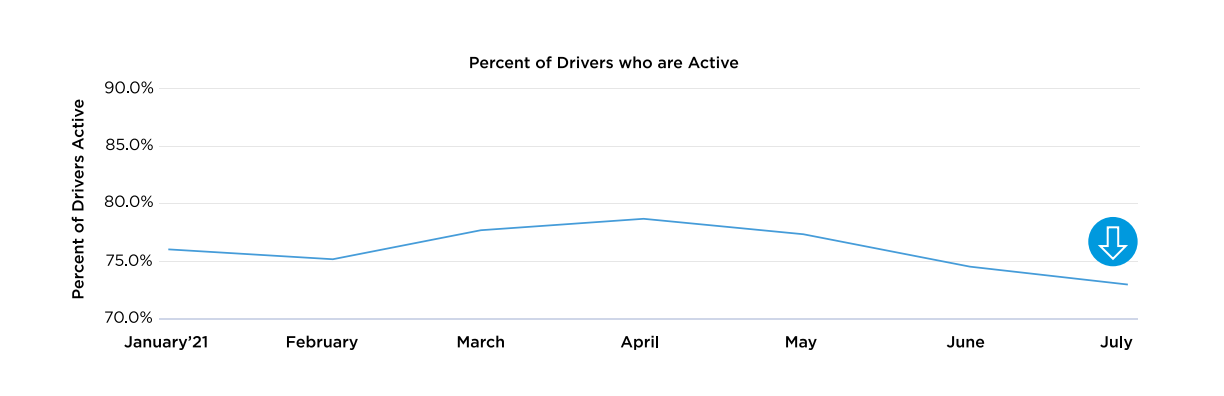

- The driver shortage continues. The trucking industry has consistently been discussing the declining numbers of drivers in the U.S. and data shows that the percentage of active drivers has dipped to 73% (July 2021). For context, this figure is lower than the usual “slow season” in active drivers that follows the busy winter holiday season.

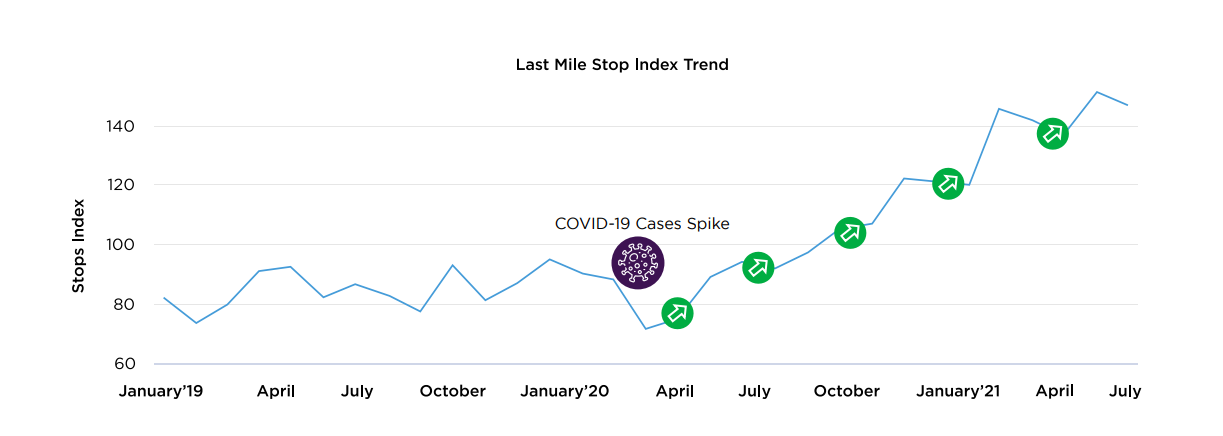

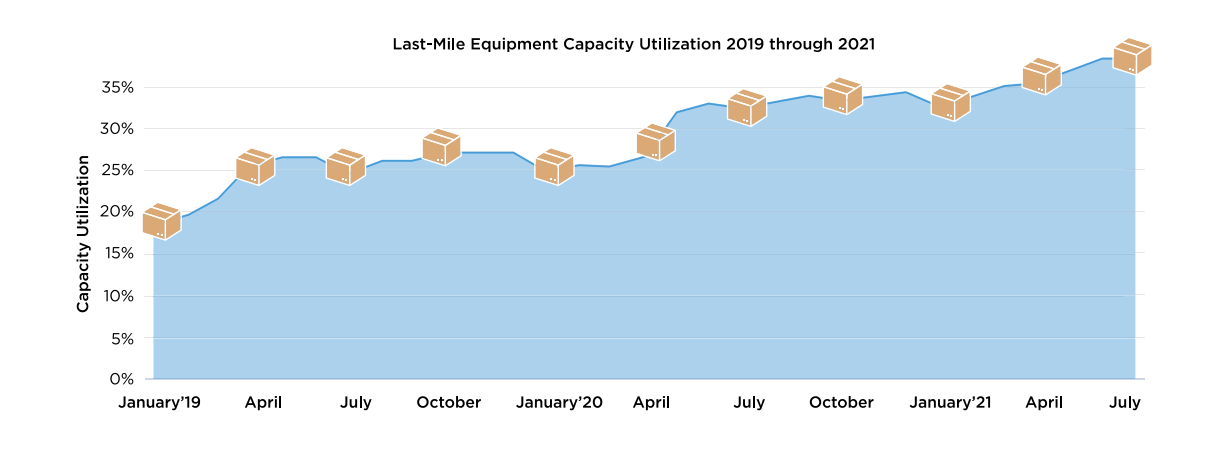

- Last-Mile delivery is continuing to grow. While it may be known that the fleets servicing the last-mile sector experienced incredible growth since the pandemic, our study shows a 99% increase of last-mile stops serviced in a 12-month period.

Additionally, last-mile capacity (or how full the trucks are) has increased 83% in the past two years.

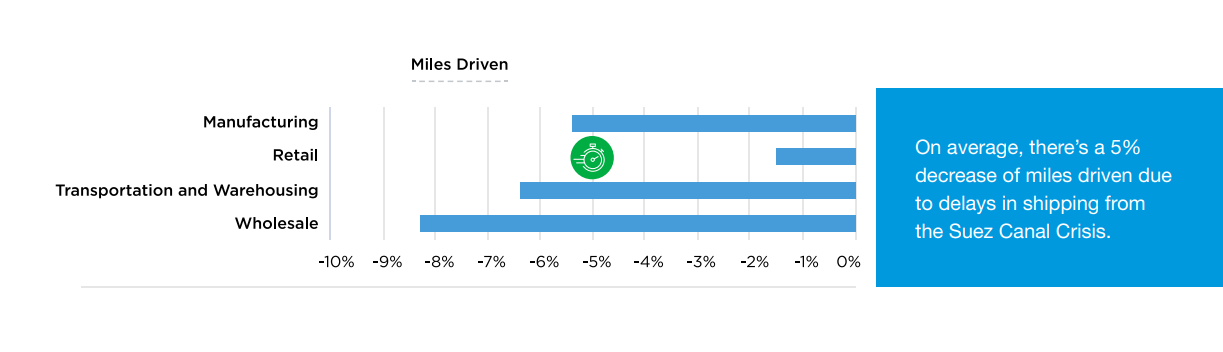

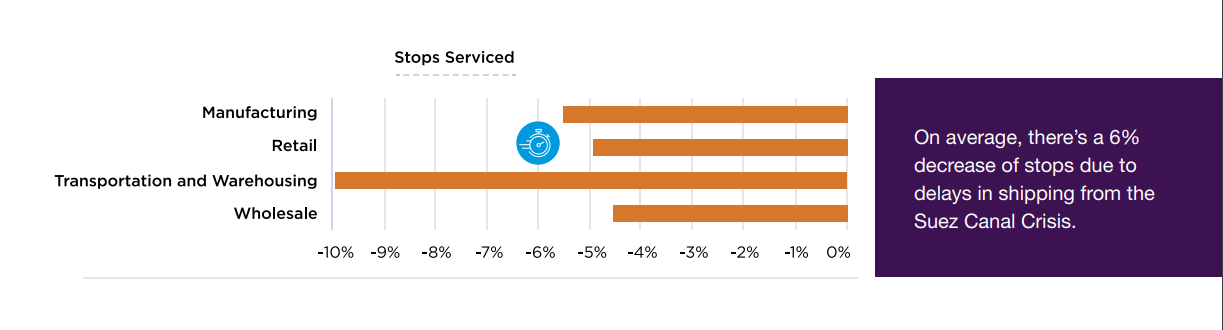

Aftereffects of the Suez Canal Crisis

Though we are now eight months removed from the bottleneck at the Suez Canal, reverberations from the event are still being felt along the supply chain as we turn the corner on 2021. Data shows that miles driven for these trucks over the measured time period has dipped by 5%. Additionally, service stops have decreased by 6%.

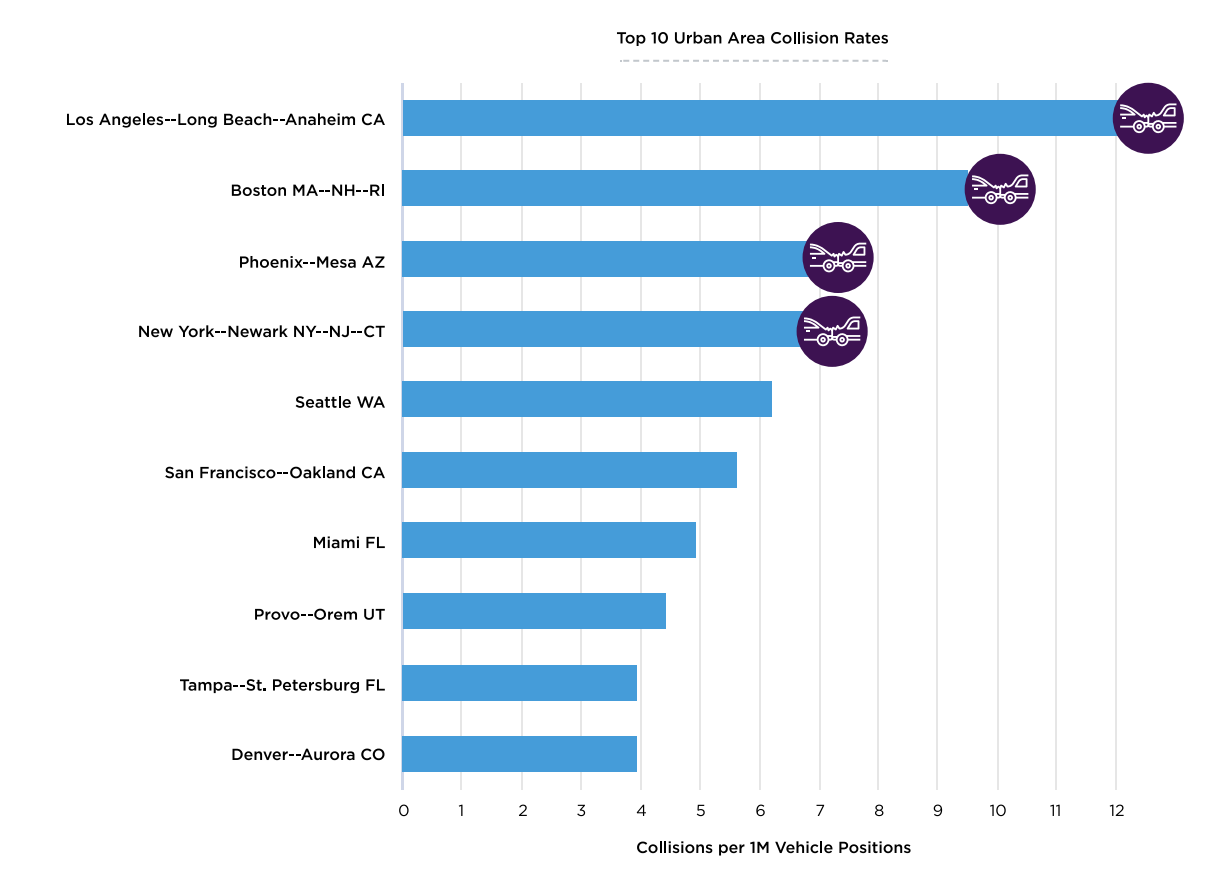

Cities Leading the Pack in Collision Risk

Analysis of transportation safety trends in urban cities provides us with a picture of which U.S. cities experience the most collisions and automotive accidents. According to the findings, Los Angeles and Boston lead the pack with the highest levels of collision rates over a 4-year period. These primary collisions are focused on police-reportable collisions – most often between two vehicles.

It is our hope that the insights from this report, and continued iterations, will allow organizations to adjust and optimize their fleet management operations with the proper prioritization of driver safety and investment strategy. Data visibility is integral to further innovation within transportation. We are able to learn from route optimization and transportation trends to adequately prepare for the future of the industry, regardless of a business’s specific needs and overall vision.

Gain valuable graphs, granulated breakdowns for your sectors and business, and an understanding of how to use past trends for stronger future business. Download the ‘Industry Intelligence Report’ today.